Trading Strategies

Top 10 Common Trading Mistakes Journaling Fixes to Prevent Losses

Chartwise Team

Feb 5, 202620 views

Learn the top 10 common trading mistakes traders make from emotional decisions to poor risk management and how to fix them for better consistency.

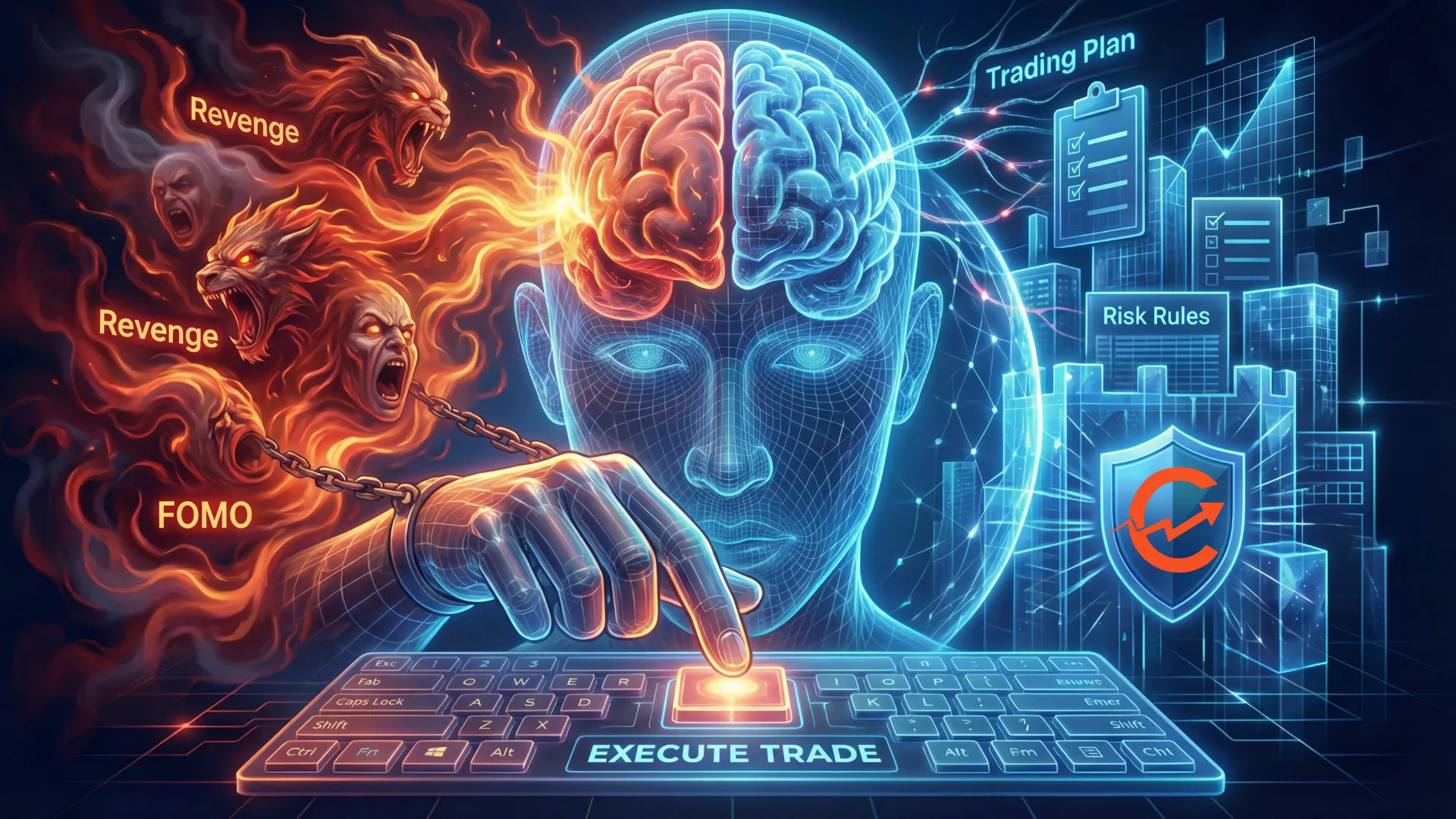

If you’ve been trading for a while, you already know this truth: the market doesn’t beat you; your own mistakes do. Every blown stop, every rushed entry, every account meltdown usually comes down to the same set of common trading mistakes. What’s surprising is that most traders repeat those mistakes over and over because they never stop to track them.

That’s where a trading journal changes the game. It's more than just a win-loss diary. It serves as a mirror that reveals the trends in your choices, the feelings that surface, and the minor errors that stealthily deplete your finances. To put it briefly, journaling transforms invisible issues into lessons that are visible, making it one of the most effective journaling fixes for traders. This process is made simple with a structured trading journal system. You get a clear, organized view of your trades, your patterns, and the faults you weren't even aware you were making instead of sifting through jumbled notes or spreadsheets, helping with long-term trading error prevention.

Before they cost you a lot of money, let's examine the top ten trading errors and see how journaling and the right tools can help you avoid losses.

Overtrading: When More Isn’t Better

One of the biggest common trading mistakes is taking too many trades. It happens when boredom kicks in or after a big win when you feel unstoppable. The problem? More trades often mean lower-quality setups and higher fees.

How journaling fixes it: When you log your trades, you’ll see the pattern instantly. A streak of 15 trades in a single day with shrinking profits becomes a wake-up call. In a good journal setup, trade frequency is tracked automatically so you can spot when you’re forcing setups instead of waiting for quality.

Revenge Trading: The “Make It Back” Trap

We’ve all been there you take a big loss, your ego gets bruised, and suddenly you’re doubling your size on the next trade, desperate to recover. Nine times out of ten, this ends badly.

How journaling fixes it: Writing down why you entered makes emotions visible. If you jot down “took this out of frustration,” you start connecting the dots between anger and more losses. A solid journaling workflow makes this easier with emotion tagging so you see how frustration or ego affected your trades and contributed to bad trading habits.

FOMO: Fear of Missing Out

Markets move fast. You see a big green candle and jump in late just to be “part of the move.” The result? You buy the top, panic on the pullback, and lock in a loss.

How journaling fixes it: By tagging entries with reasons, you’ll notice how often you write “didn’t want to miss it.” Over time, your journal will prove that FOMO trades rarely work. In a structured review, FOMO trades stand out clearly, helping you avoid repeating the same mistake.

Ignoring Risk Management

Another classic bad trading habit is skipping risk controls, trading oversized positions, or placing stops way too tight (or not at all). The math never lies: poor risk management eventually wipes you out.

How journaling fixes it: A journal forces you to write down position size, stop-loss, and risk-to-reward before entering. The best systems take it a step further by automatically calculating your risk metrics and highlighting when you’re breaking your own rules.

Not Sticking to a Plan

Many traders start with a clear plan but abandon it the second emotions show up. Maybe you cut a winner early, or you move your stop because you “feel” it’ll turn. That inconsistency kills results.

How journaling fixes it: Recording both your original plan and the actual execution highlights every time you broke your own rules. Seeing those differences on paper builds discipline fast and supports long-term trader improvement.

Chasing Hot Tips and Noise

It’s tempting to trade based on what a guru on Twitter said or what’s trending in a chat room. The problem? By the time you act, the move is usually over.

How journaling fixes it: Writing down “reason for entry” exposes just how often trades come from noise rather than analysis. Over time, you’ll get embarrassed by how many “hot tip” trades lose money. A structured journal helps by forcing consistent trade tagging, so you can see whether your edge comes from analysis or noise.

Holding Losers Too Long

Hope is not a strategy, but many traders hold onto losing positions, praying they’ll turn around. Usually, they don’t.

How journaling fixes it: By tracking average hold times for winners versus losers, you’ll see a clear imbalance. In a good analytics-style journal, those stats are automatically calculated, and when you notice losers dragging for days while winners get cut short, the data speaks for itself.

Taking Profits Too Early

The opposite of holding losers is cutting winners too soon. Many traders cash out small gains out of fear, leaving far more money on the table.

How journaling fixes it: Your journal shows the difference between your actual exits and where the setup was designed to go. Over time, you’ll trust your targets and hold your winners longer. A clear dashboard view can visualize this with exit efficiency metrics, so you know exactly when fear is robbing your profits.

Ignoring Market Context

A valid setup in the wrong market environment is still a bad trade. Taking breakout trades in a choppy market or fading trends in a strong trend is a recipe for losses.

How journaling fixes it: Writing down context, trends, volatility, and news events helps you connect performance with conditions. With the right setup, you can overlay your trades against market conditions to see when your strategies align with the environment and when they don’t.

Skipping Self-Review

The worst mistake of all? Not reviewing at all. Many traders think their broker history is enough. But without self-reflection, you’ll never see the emotional triggers or recurring errors behind the numbers.

How journaling fixes it: A trading journal creates a built-in review system. Weekly or monthly, you can scan through notes and spot repeated behaviors that cost you money. A clean dashboard makes this review process simple by showing you patterns in seconds.

A Simple Tool That Makes Journaling Easier: ChartWise

If you like the idea of journaling but hate how clunky it gets in spreadsheets or random notes, ChartWise is built for that exact problem. It helps traders log trades without friction, review charts with proper context, and spot patterns that are easy to miss in raw broker statements. Instead of trying to “remember” why you took a trade, you can attach quick notes, tags, and screenshots so your decisions are clear later. The biggest value is that it turns journaling into something practical: clearer reviews, cleaner chart-based analysis, and better decisions over time without the mess.

The Big picture

These mistakes aren’t random accidents; they’re predictable habits. The difference between traders who keep losing and those who grow is whether they learn from them.

That’s exactly why we built ChartWise: to make journaling effortless, insightful, and actionable. From emotion tagging to risk tracking to performance dashboards, ChartWise turns your raw trades into clear lessons.

Don’t wait for the next mistake to cost you money. Start using ChartWise today and turn bad habits into your biggest trading edge.